Hanesbrands Inc (HBI) Intrinsic Value Assessment

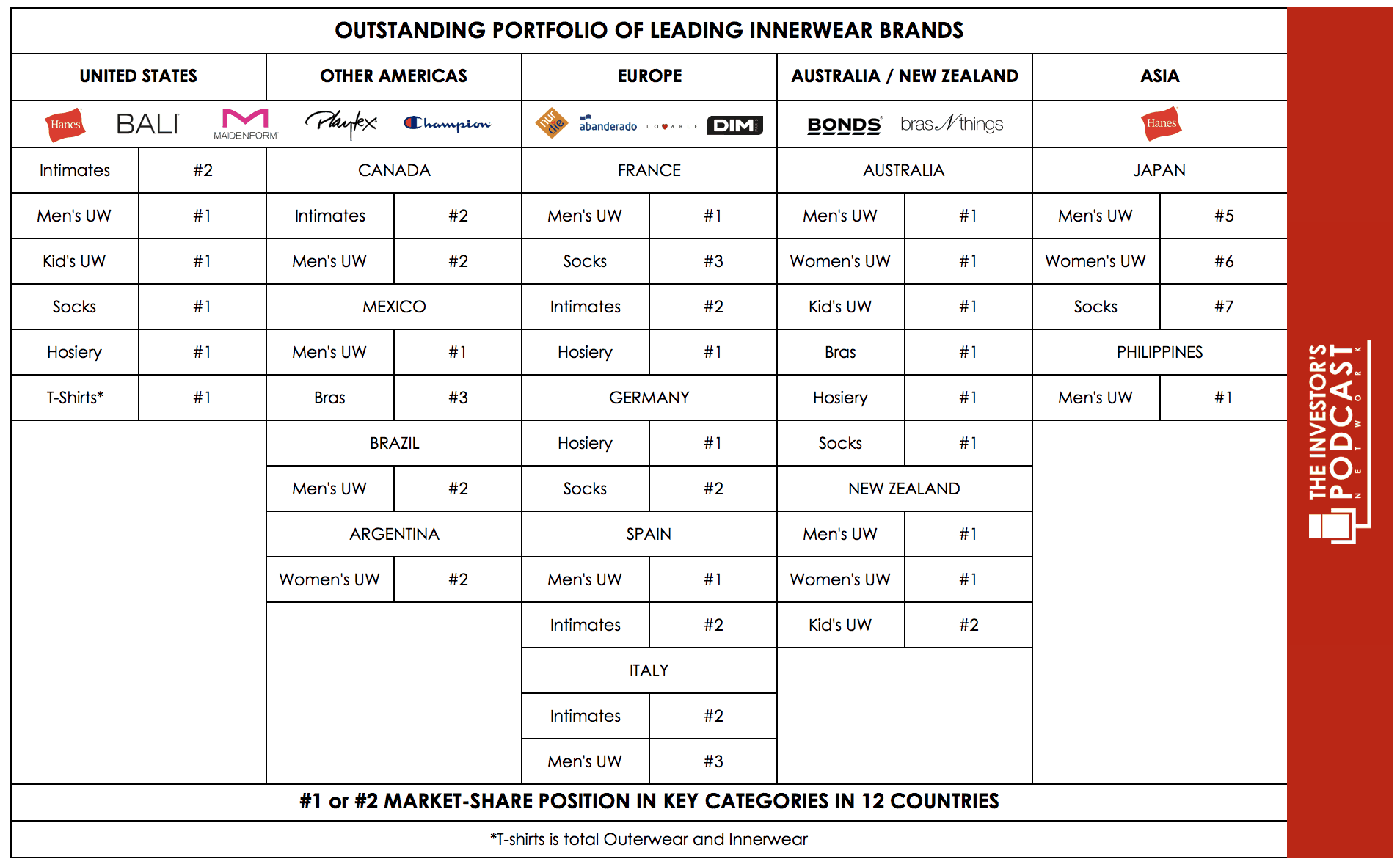

Read the Intrinsic Value Assessment of Hanesbrands Inc (HBI), a leading manufacturer of everyday basic innerwear and activewear apparel.

V.F. Corp. And Hanesbrands - Debt Vs. Dividends (NYSE:HBI)

What are the Michael Porter's Five Forces of Hanesbrands Inc. (HBI).

Hanesbrands Inc.'s (NYSE:HBI) Intrinsic Value Is Potentially 89% Above Its Share Price

Stock Crash Alert: My No. 1 Deep Value Stock Now a 'BUY

Boyar's Intrinsic Value Research Forgotten Fourty, PDF, Interest Rates

Is Hanesbrands (HBI) Too Good to Be True? A Comprehensive Analys

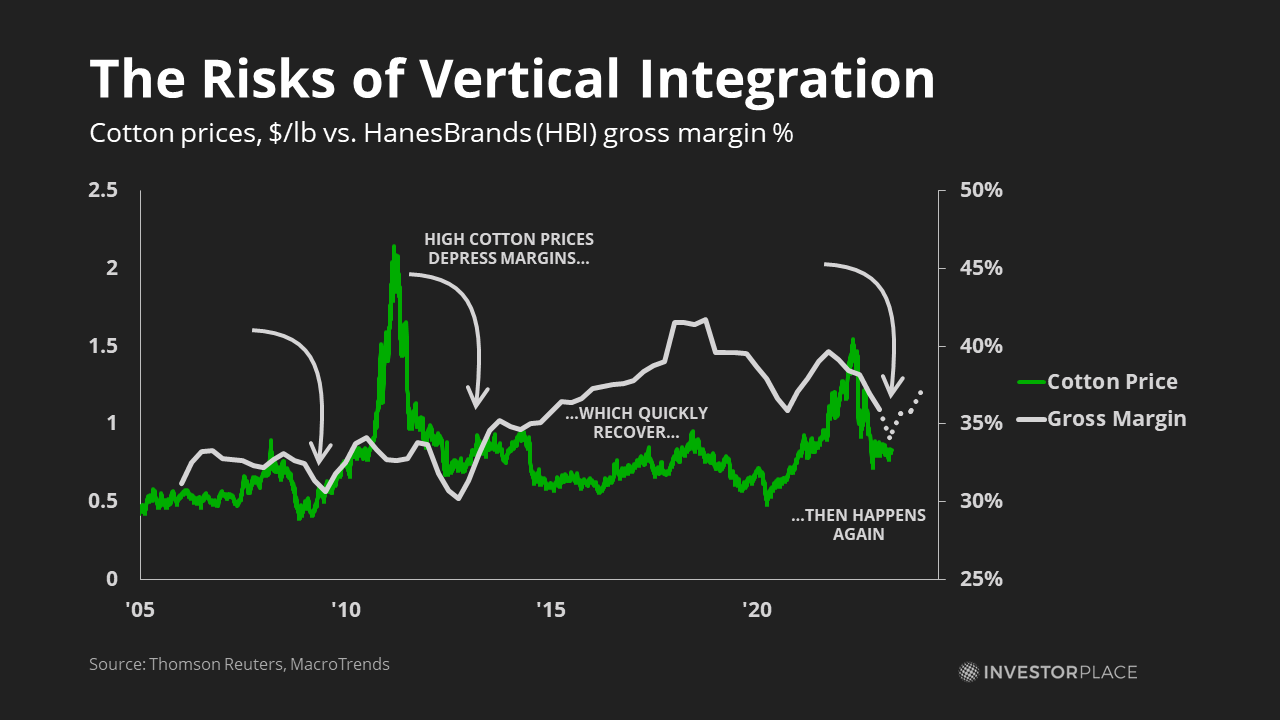

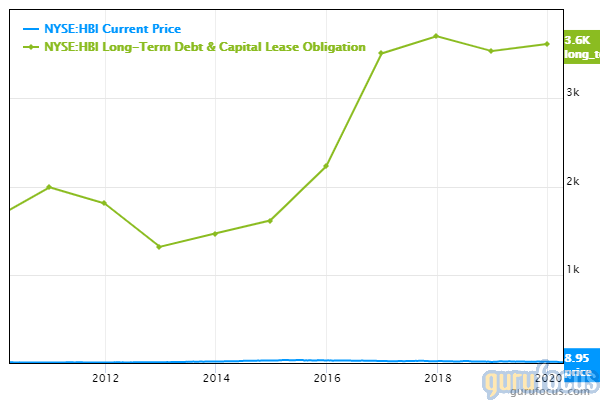

Hanesbrands: Big Bargain, Big Debt

Hanesbrands: Big Bargain, Big Debt

Does Hanesbrands Inc's (NYSE:HBI) Debt Level Pose A Problem?

/wp-content/uploads/2024/02/S

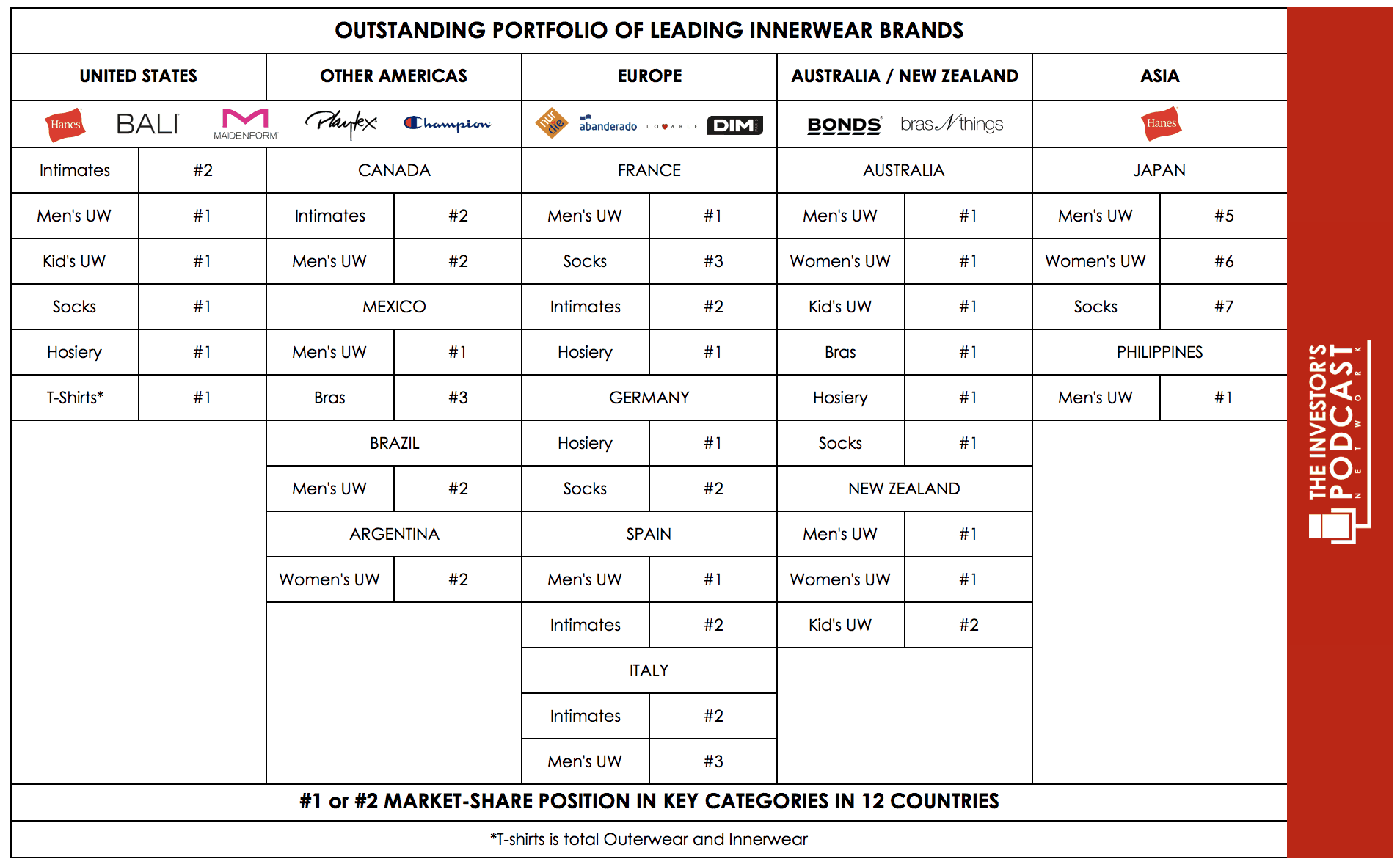

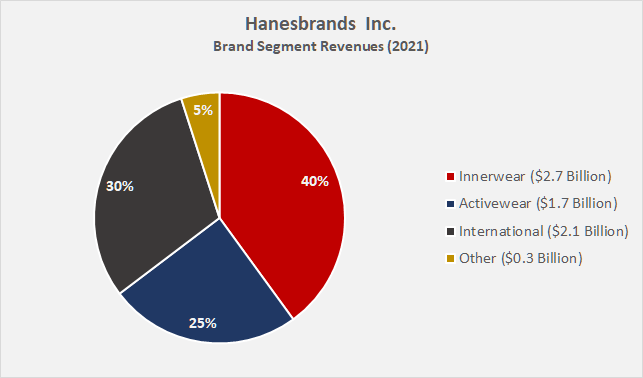

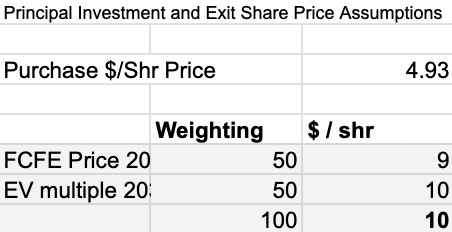

Our new investment idea: Hanesbrands Inc (NYSE: HBI)

Hanesbrands Inc (HBI) Intrinsic Value Assessment